Zetra Iez Zaputra

Independent Researcher. Jakarta, Indonesia.

Email: zetra006 (at) gmail (dot) com

https://doi.org/10.5281/zenodo.10643986

The market dynamic of Gundam Plastic Model Kits, Gunpla for short, has changed since the producer’s business strategy shifted to achieve more growth outside of the Japan Domestic Market. One of the signs of this strategy shifting is that now, Bandai Namco broadcasts the Gundam series, both the old series or newer series on the same day as Japan, on the gundam.info YouTube channel that can be accessed by people outside Japan.

The author would like to assess the market dynamic of Gunpla in Indonesia through the lenses of several factors in the marketing mix. The assessment of the situation is done by collecting primary data through a market survey and secondary data from the Internet and market observation.

GUNDAM PLASTIC MODEL KITS

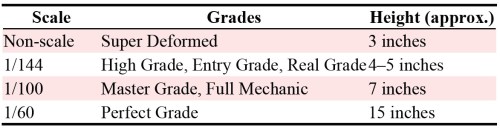

Gunpla is produced by Bandai (through Bandai Spirits) since 1980 and it is popular among mecha anime (anime featuring robots) fans and model enthusiasts around the world. Well-known lineups of Gunpla for collectors nowadays can be seen in the table below.

Bandai always announces its upcoming products several months before the release date. After the announcement, people can pre-order from their favorite retailers. For Premium Bandai exclusive products, the order can be done through the Premium Bandai website.

DISCUSSION

We will discuss Indonesian Gunpla consumers through some of the components of 7Ps Marketing Mix (Charted Institute of Marketing, 2015), which are Products, Price, Place, and Promotion. We will also discuss what Gunpla collectors in Indonesia collect other than Gunpla.

To understand consumer spending, we did a survey in February 2023 with 400 people through some Gundam-related Facebook groups in Indonesia, like Gundam Community Indonesia, Gundam Nusantara Indonesia, and Mecha Hujatposting Indonesia. 400 samples satisfy the need to have a confidence level of 95% that the real value is within ±5% of the surveyed value. Even so, there are some limitations, since surveys are prone to sampling bias, state preference bias, or question framing bias. The survey and summarized results can be found in the Appendix.

Product

Gunpla is well known for its quality and easiness to build. It is this quality advantage that makes Gunpla more easily accepted by the market. The products come with the parts in plastic sprue, manual, and box package with illustration and model explanation on it. The design of the Gunpla is based on the mecha that appeared in the Mobile Suit Gundam series. Depending on the grade, the design could be similar to the series or have certain modifications either in proportion, details, or added gimmicks.

From our survey, 98% of the sample stated that they buy a Gunpla because of the design of the kit. Even so, 32.75% stated that faithfulness to the source material is not the reason they buy the kit. This could be anticipated by Bandai since some grades like Master Grade do redesign and give more gimmicks (sliding parts, added joint, more panel lines) to the kit. For newer kits, the design usually has more panel lines than how the character appeared in the source material. For comparison, 1/100 Gundam Barbatos and Master Grade Gundam Barbatos have different proportions, engineering aspects, panel lines, and prices despite having the same scale (Fig. 1).

Price

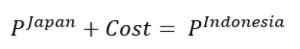

As imported goods, we analyze how the price can be explained with

where the price of Gunpla in Indonesia is the price of Gunpla in Japan plus added costs (i.e., import, customs, and tax). We compare some prices of items in different conditions, which are pre-order and ready stock, since it is normal in the market to have differences in price for pre-order and ready stock.

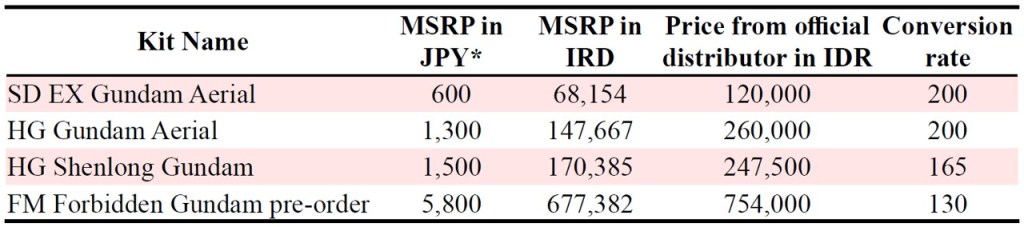

We compare the ready stock price of SD EX Gundam Aerial, High Grade Gundam Aerial, and High Grade Shenlong Gundam that were released in September–October 2022. All of them arrived in Indonesia around the end of 2022. To add more comparison, I also included FM Forbidden Gundam, available for pre-order in the end of March 2023. The exchange rate we used for the SD EX Gundam Aerial, HG Gundam Aerial, and HG Shenlong Gundam is the rate on Dec 1st 2022 (JPY/IDR @115.39), while for FM Forbidden Gundam pre-order we used the rate on March 20th 2023 (JPY/IDR @116.79). The comparison can be seen in Table 2.

The variation of conversion rate is different between pre-order price, the ready stock price for regular items with a high level of popularity, and the ready stock price for items with low-to-mid popularity. Price differences between ready stock and pre-order items are considered normal while the price differences between highly popular and low-to-mid-popularity items is debatable.

For Premium Bandai Gunpla, since there is no access to Premium Bandai in Indonesia, consumers can get Premium Bandai Gunpla from resellers in Indonesia. The price is approximated at a 200 conversion rate or higher. For example, Master Grade Gundam Stormbringer with a Yen price of JPY 5,400 is sold in Indonesia at IDR 1,350,000.

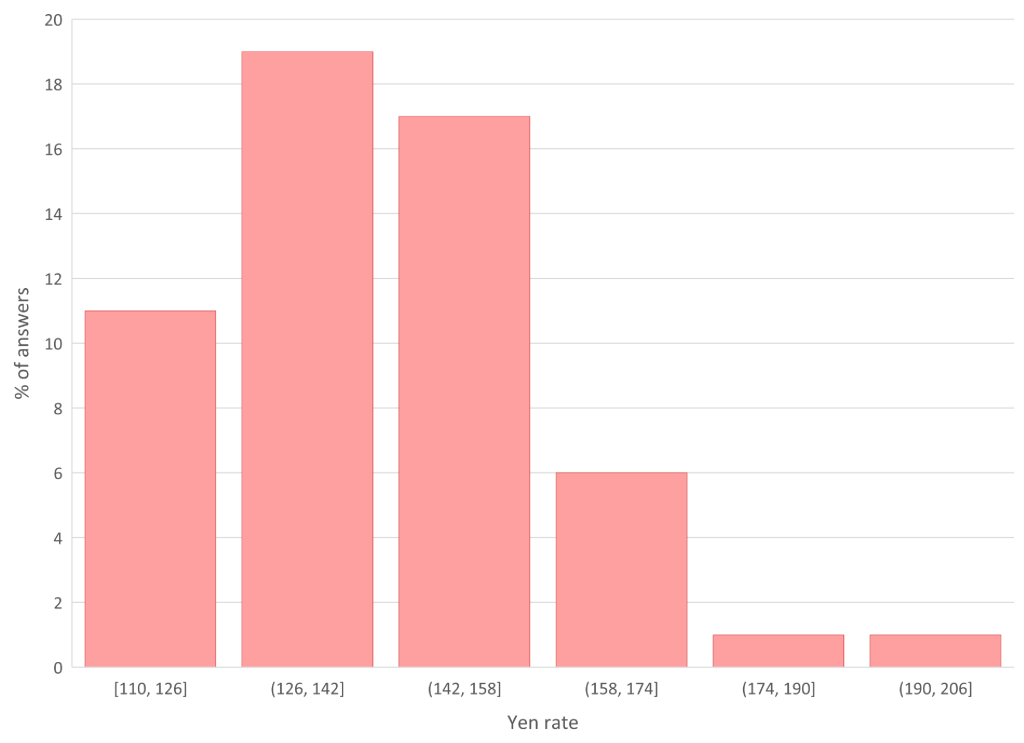

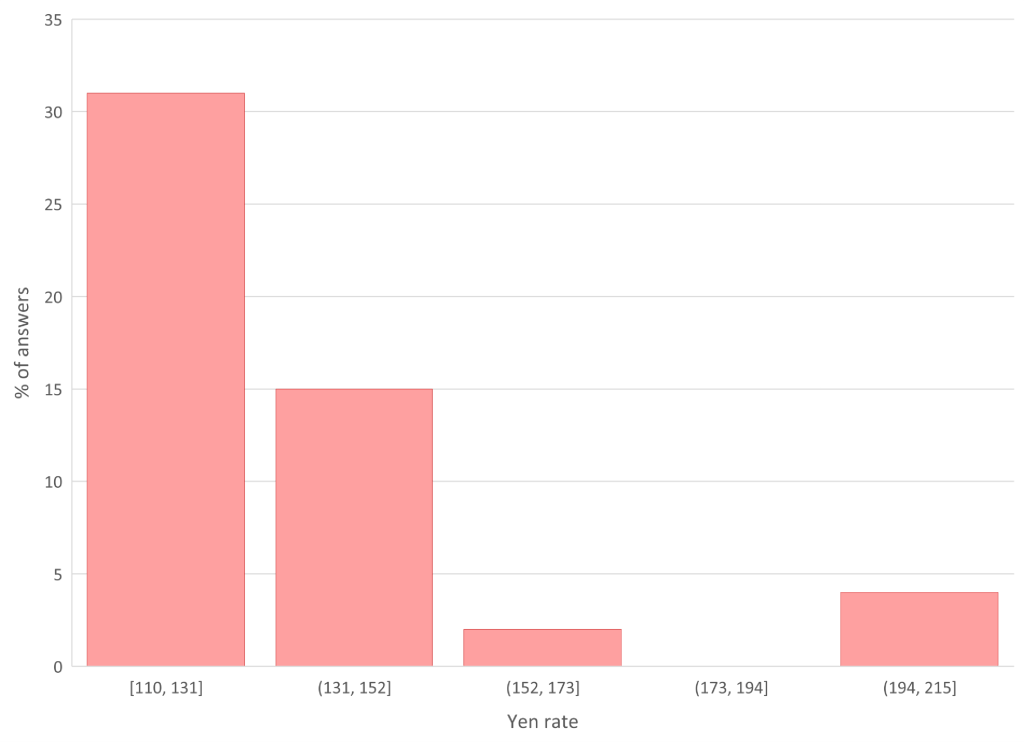

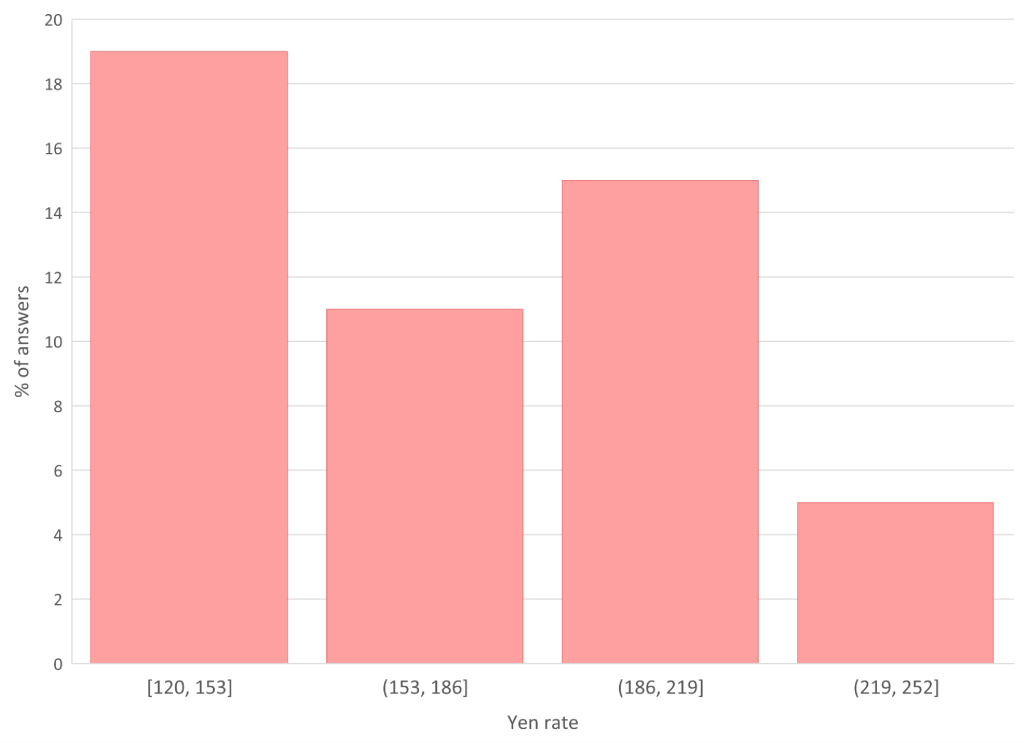

We collected data on how much it is the conversion rate people are willing to pay for three item categories, which are regular-popular, regular-normal, and limited. The histograms are shown in Figures 2 to 4. From the data, there is a bit mismatch between the willingness to pay and the retail price in Indonesia. Looking at the current market conditions, Gunpla sales are mostly helped by the popular ones (main character units) rather than by those that are not really popular (grunt units or antagonist units). Not everyone is familiar with the JPY price of Gunpla but eventually, they will learn after some time.

One unique phenomenon in the Indonesian market is that there is a “By Air” price for regular Gunplas that arrive in Indonesia approximately one month after release in Japan. The conversion rate of the price is about the same with limited Gunpla. This price difference occurs because there are extra costs borne from importing the goods by the sellers. This phenomenon occurred because normally through the official channels, Gunpla arrive in Indonesia about three months after released in Japan.

While cheaper line-ups like High Grade and Entry Grade are intended to create a low entry barrier for newcomers, the price level cannot be considered low in Indonesia. From CEIC data, the monthly earnings of Indonesia in 2022 is USD 192 (around IDR 2.8 million), very low compared to Japan (USD 2,122). This income level itself is already a challenge to sell a large quantity of Gunpla and might be a problem since Gunpla creates profits through a large number of sales.

Place

Consumers can buy Gunpla products from sellers through online marketplaces such as Tokopedia or Shopee, social media platforms, or in physical stores. The price between sellers varies. Some people can import Gunpla by themselves, but the price will be around the “By Air” price mentioned above.

Promotion

Bandai promotes Gunpla products for people outside of Japan through their social media and gundam.info YouTube channel. For new items showcase, Bandai also collaborates with local distributor Multi Toys in Indonesia to run events like Pop-up stores, Gundam Builders World Cup, or dedicated booths in toys fair events. In some events, usually, there are discounts to boost sales.

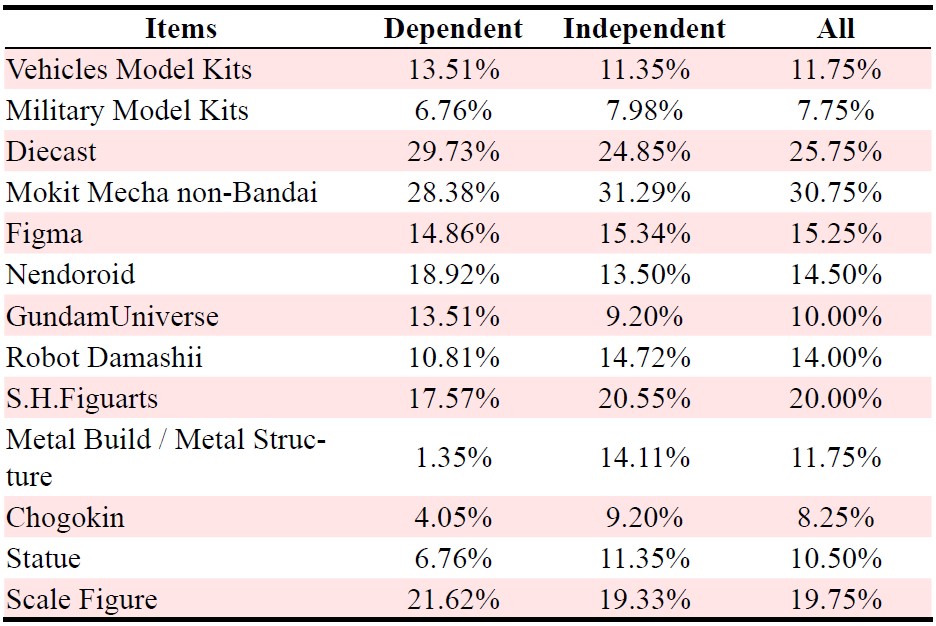

Other collections

We would like to discuss other toys that Gunpla consumers collect since some of them, in this case bootlegs, are a threat to Gunpla. Also, understanding other lineups give us a better understanding of consumers’ preferences for other hobbies in the Gunpla community. We divided the respondents according to how they earn their income, i.e., still earn it from their parents or are already financially independent. The result is shown in Table 3.

Consumers divide third-party products into four categories. They are: (1) copies of the original, as in directly using the mold of original Gunplas; (2) modified copies of the original, where the original Gunpla is released by Bandai but with different details; (3) characters that are not yet released by Bandai; and (4) just the add-ons. Third-party products for Gunpla are not licensed by Bandai and can be a threat due to their lower prices in comparison. This has been anticipated by Bandai by setting a fairly cheap price for the High Grade kits, which are intended for newcomers.

CONCLUSION

While Bandai as Gunpla producer already widens its promotion to overseas markets, including Indonesia, we found a mismatch between the Gunpla retail prices and consumers’ willingness to buy in Indonesia. This mismatch is plausibly bad news for Gunpla producer and local distributor since Gunpla relies on a high volume of sales to generate profit. Relying on discounts, especially when the hype is already down, is not a good business practice. This mismatch also paved the way for third-party products since their prices are lower and the intended newcomers, which are high school students, do not really have a high willingness to pay for third-party products. This condition can be mitigated by doing adjustments to the price level of Gunpla products so that sales volume can be increased and maintain sustainable business practices in Indonesia.

In future studies, it will be important to consider factors such as demand price elasticity and marginal costs of production to validate the hypothesis. These factors play a crucial role in understanding the dynamics of the market and assessing the feasibility and viability of the proposed hypothesis. It is also important to study the shelf life of the Gunpla hobby and the possibility of switching hobbies or collections in the community to gain more insight into purchasing behavior.

REFERENCES

Charted Institute of Marketing. (2015) 7Ps: A brief summary of marketing and how it works. The Chartered Institute of Marketing (CIM), Berkshire.

Officer, L.H. (1976) The Purchasing-Power-Parity Theory of exchange rates: a review article, International Monetary Fund Staff Papers 23(1): 1–60.

Statistic Indonesia. (2022) In September 2022, the poor population percentage was up to 9.57 percent. Available from: https://www.bps.go.id/pressrelease/2023/01/16/2015/persentase-penduduk-miskin-september-2022-naik-menjadi-9-57-persen.html (Date of access: 19/May/2023).

CEIC. (2023) Indonesia Monthly Earnings. Available from: https://www.ceicdata.com/en/indicator/indonesia/monthly-earnings (Date of access: 24/May/2023).

GundamInfo. (2023) GundamInfo. YouTube. Available from: https://www.youtube.com/@GundamInfo (Date of access: 24/May/2023).

About the author

Zetra Iez Zaputra is a Bachelor of Management alumni from a certain campus in Bandung, Indonesia. In his free time, he builds Gunpla, takes pictures of his toys, watches anime, or browses online marketplaces to find additions to his collections.

APPENDIX: Survey questions and summary of answers

Demographics of the respondents

- Tingkat pendidikan terakhir. (Education level.)

- Elementary School (0)

- Junior High School (3)

- Senior High School (117)

- Diploma 1 (4)

- Diploma 2 (0)

- Diploma 3 (25)

- Diploma 4 (3)

- Bachelor (215)

- Masters (31)

- PhD (1)

- Apakah Anda berpenghasilan sendiri atau masih menjadi tanggungan? (Do you have your own income or are you still a dependent?)

- Independent (326)

- Dependent on parent/guardian (74)

- Rata-rata pendapatan Anda per bulan. (Your average monthly income.)

- <IDR 500,000 (44)

- Between IDR 500,000 – 1 million (34)

- Between IDR 1 – 3 million (95)

- Between IDR 3 – 5 million (71)

- Between IDR 5 – 7 million (49)

- Between IDR 7 – 10 million (47)

- Between IDR 10 – 15 million (28)

- > IDR 15 million (32)

- Apakah anda sudah berkeluarga? (Are you married?)

- Yes (133)

- No (267)

- Region tempat tinggal Anda? (What region do you live in?)

- Bali dan Nusa Tenggara (11)

- Kalimantan (22)

- Jawa (332)

- Overseas (3)

- Papua (1)

- Sulawesi (9)

- Sumatera (22)

Purchasing Behavior

- Berapa rata-rata pengeluaran Anda untuk membeli Gunpla dalam sebulan dalam Rupiah? (How much do you spend on average to buy Gunpla in a month, stated in IDR?)

- Median (IRD 500,000)

- Q1 (IRD 300,000)

- Q3 (IRD 1,000,000)

- Lowest (IRD 50,000)

- Largest (IRD 50,000,000)

- Apakah Anda selalu menonton film / membaca komik dari Gunpla yang Anda beli? (Do you always watch films / read comics of Gunpla that you buy?)

- Yes (61.5%)

- No (38.5%)

- Apakah desain Gunpla menjadi salah satu daya tarik dari Gunpla yang Anda beli? (Is the Gunpla design one of the appeals of the Gunpla you buy?)

- Yes (98%)

- No (2%)

- Apakah popularitas Gunpla menjadi salah satu daya tarik dari Gunpla yang Anda beli? (Is the popularity of Gunpla one of the appeals of the Gunpla you buy?)

- Yes (40.75%)

- No (59.25%)

- Apakah kesesuaian Gunpla dengan yang muncul di media (film/komik/novel/dll) menjadi salah satu daya tarik dari Gunpla yang Anda beli? (Is Gunpla’s faithfulness with what appears in the media (movies/comics/novels/etc.) one of the appeals of the Gunpla you buy?)

- Yes (67.25%)

- No (32.75%)

- Bagaimana desain kit menurut Anda? (How important is the kit’s design for you?)

- Very not important (1.00%)

- Not important (0.75%)

- Important (16.00%)

- Very important (82.25%)

- Bagaimana kepopuleran kit menurut Anda? (How important is the kit’s popularity for you?)

- Very not important (14.00%)

- Not important (59.25%)

- Important (21.75%)

- Very important (5.00%)

- Bagaimana kesesuaian kit dengan di media sumber menurut Anda? (How important is the kit’s faithfulness to source media for you?)

- Very not important (6.25%)

- Not important (42.00%)

- Important (35.25%)

- Very important (16.50%)

- Bagaimana ukuran kit menurut Anda? (How important is the kit’s size for you?)

- Very not important (4.50%)

- Not important (30.75%)

- Important (41.75%)

- Very important (23.00%)

- Untuk barang reguler yang populer, berapa rate dari harga yen paling tinggi untuk Anda beli? Rate JPY-IDR BCA per 3 Februari 2023 adalah Rp115,68/Yen. (For popular regular items, what is the highest Yen rate for you to buy? BCA’s JPY-IDR rate as of 3 February 2023 is IDR 115.68/JPY.)

See Figure 2.

- Untuk barang reguler yang tidak populer, berapa rate dari harga yen paling tinggi untuk Anda beli? Rate JPY-IDR BCA per 3 Februari 2023 adalah Rp115,68/Yen. (For unpopular regular items, what is the highest Yen rate for you to buy? BCA’s JPY-IDR rate as of 3 February 2023 is IDR 115.68/JPY.)

See Figure 3.

- Untuk barang limited, berapa rate dari harga yen paling tinggi untuk Anda beli? Rate JPY-IDR BCA per 3 Februari 2023 adalah Rp115,68/Yen. (For limited items, what is the highest Yen rate for you to buy? BCA’s JPY-IDR rate as of 3 February 2023 is IDR 115.68/JPY.)

See Figure 4.

- Apakah Anda mengoleksi produk 3rd party? (Do you collect third-party products?)

- Yes, different detail with existing (31.25%)

- Yes, copy of the existing kit (26.25%)

- Yes, no existing kit (23.25%)

- Yes, add-on (23.50%)

- No (41.00%)

- Lini mainan apa saja yang Anda koleksi selain Gunpla? (What other toy lines do you collect besides Gunpla?)

- Vehicles Model Kits (11.75%)

- Military Model Kits (7.75%)

- Diecast (25.75%)

- Mokit Mecha non-Bandai (30.75%)

- Figma (15.25%)

- Nendoroid (14.50%)

- GundamUniverse (10.00%)

- Robot Damashii (14.00%)

- H.Figuarts (20.00%)

- Metal Build / Metal Structure (11.75%)

- Chogokin (8.25%)

- Statue (10.50%)

- Scale Figure (19.75%)